After two consecutive months of sharp declines an index that monitors Indiana’s economic sentiment in the state’s ag sector has stabilized.

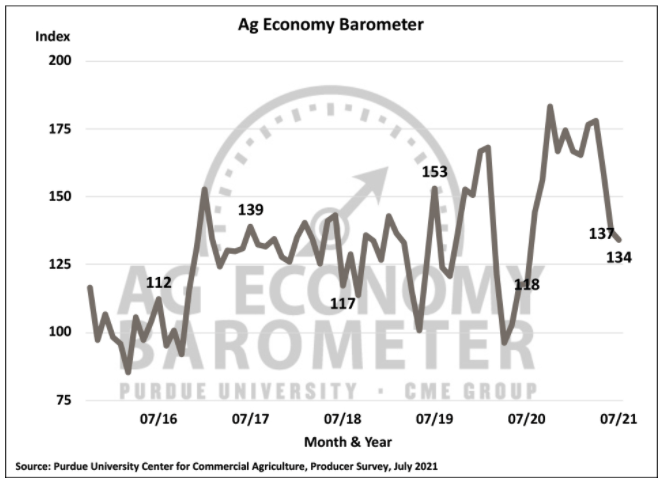

Researchers for the Purdue University/CME Group Ag Economy Barometer said the index “leveled off” in July, falling three points to reading of 134 in July. Both producers’ sentiment regarding current and future conditions also dropped.

The Index of Current Conditions was down six points to 143, primarily as a result of weakened principal crop prices, researchers said. The Index of Future Expectations was down two points to 130.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between July 19 and July 23.

July’s index marked the lowest barometer reading since July 2020 and marked a return to sentiment readings observed between 2017 and 2019, when annual average barometer readings ranged from 131 to 133.

Producers’ sentiment regarding their farms’ financial condition was more optimistic when prices for corn, soybeans and wheat were surging last fall, winter, and early spring, researchers said. Recent sentiment readings suggest farmers remain cautiously optimistic about financial conditions on their farms.

There was a modest improvement in the Farm Financial Performance Index, which asks producers about expectations for their farm’s financial performance this year compared to last year. The index improved three points from last month to 99 and remains 43% higher than in July 2020 when the index stood at 69.

The Farm Capital Investment Index declined for the fourth consecutive month down four points to a reading of 50. Weakness in the investment index was primarily attributable to more producers indicating they plan to reduce their farm building and grain bin purchases in the upcoming year, researchers said.

About two-thirds of July’s respondents said their construction plans were lower than a year earlier, compared to 61% who indicated that in June. Plans for farm machinery purchases were also somewhat weaker, with a shift of more respondents planning to reduce their machinery purchases compared to last year instead of holding them constant, researchers said.